Chris Burrell Market View Blog - October 2024

Chris Burrell Market View Blog - October 2024

Themes of 2024 – 2025

Introduction - This is the second instalment of Themes for the 2024 – 2025 Financial Year.

US Election: Market Non-Reaction

The US presidential election will be held on 06th November 2024.The two protagonists, Harris and Trump are polling such that the race is too close to call. The tax policies of the two candidates are materially different. Kamala Harris has a corporate tax increase from the current 21% to 28% as a part of her policy campaign. Donald Trump on the other hand initially talked of reducing the 21% corporate tax rate to 20% and then said, why not make it 15%?

The discounted cash flow analysis of US corporates is sensitive to tax rates as they are a cost incurred every year and the net cash flow after tax for each year is the base number to discount. There is thus potentially a 13% difference between the two candidates in tax cash flows every year. An annuity would multiply this by 10 times i.e. 130% difference. Yet the market has not moved.

An explanation may be that as in Australia, voters will often elect different parties in the House of Representatives and the Senate. Likewise commentators have suggested that the US electorate will have a different party in the majority in the Senate as compared to the Congress and so it is likely that no matter who is President, these extremes of tax policy will not be legislated.

Both parties suffer from delivering ongoing high deficits. The Republicans cause of high deficits is that taxes are too low, while the Democrat’s problem is that expenditure is too high. Policies in the middle with some focus on the deficit would be preferred, but currently are nowhere to be sighted.

China ‘Stimulus’, Market Over Reaction

China is facing a number of issues resulting from the Leninist Philosophy of Xi Jinping and the shortcomings of planned economies, particularly in the property market. The over building which occurred resulting in residential towers being empty has been broadly canvassed. Policies to deal with this oversupply mean that less raw materials from Australia are required in terms of steel making and other products related to building.

Recently the Chinese government announced a vague ‘stimulus’ package in advance of the national holiday week in China. Economic commentators were somewhat underwhelmed by the announcement, including its lack of specifics, but stock markets assumed there would be more to come and have been positive. An uptick in Australian resource stocks was also noted, although there has been a little softening as it became clear the announcements were underwhelming.

In a related matter, China is Australia’s largest trading partner. Our current standard of living is due in no small measure to the riches that have flowed to Australia from exports to China over the past 30 years. It is good to see the Albanese government has worked hard to reestablish a more normal trading relationship with China.

Disrupted Industries: Energy --> To upstream

Disrupted industries tend to result in lower profit as incumbents jostle to adapt to the disruption, new entrants arrive and there is a tendency to chase revenues at the expense of bottom line profits. We saw this in the Telco sector for over a decade, although more recently a more rational set of players have emerged in the Telco industry.

A major concern in Australia currently is the energy industry. There are widely different policies between the two major parties in Canberra. This is resulting in no clear guidelines for business and so the result is that business will not be prepared to invest sufficient amounts to implement the energy transition, whatever that may be. Another factor is that the rhetoric around green outcomes of solar and wind has also been in advance of the economic and technical realities of what can be achieved.

Thus while those within the industry draw graphs of steaming coal phasing down, solar (PV) and wind increasing with some limited contribution from other sources such as pumped hydro, those graphs invariably use gas as the balancing transitional fuel to any outcome which may be approximately carbon neutral. Gas has half the carbon emissions of coal and your diarist and many others believe it is the only viable transition fuel in the next two decades.

Yet in Canberra we have some law makers who are not prepared to recognize gas as the transition fuel and continue to propound solar and wind as the outcomes, when neither is sufficient when the wind does not blow and the sun has set. Part of the misinformation around these debates is the lack of capital required for this transition. Continuing to issue press releases that sun and wind is free, when the capital costs are high and transmission lines for this direct voltage current also include material capital costs, is not helpful to a rational argument.

So far the energy retailers have made minor commitments, seeing others such as industry super funds and the government as those that should incur the capital costs. There is a real risk that governments will seek to impose these costs onto the energy retailers, particularly as forecast, Sydney faces blackouts of 2- 3 days from 2027.We have already seen the NSW Government allocate funds to extend the life of a major coal fired power station.

The potential for the energy retailers to be disrupted is quite high, as currently their profits are in no small part due to charging say $0.34/kwh but only paying $0.05 for solar (PV) contributed back to the grid. This is an addition to the risks noted above.

On the other hand the gas producers in Australia are trading at attractive valuation multiples. This may partly reflect the view by some economists that Saudi Arabia may be prepared to pump more oil to reduce the oil price. The gas price is a fraction of the oil price, often 13%.LNG demand from Asia is strong and likely to remain so, as a number of allied countries wish to reduce dependence on Russian natural gas, having seen the Kremlin weaponise this in regard to Ukraine. Australian and PNG LNG will continue to find favor in Asia and so the upstream gas companies in Australia continue to look good strategically.

Overbought Sectors: Banks, Data Centers & AI

Banks are expensive in Australia. Historically banks were valued as a factor of their book value. If a bank was valued at say one times book value as some of the European banks were during the Global Financial Crisis and Covid, that was viewed as most attractive. A bank’s valuation at 1.5 – 2 x were generally viewed at about right, although two times was seen by some as a touch expensive.

Commonwealth Bank is universally viewed as overvalued by the analysts trading at 3.28 x book value. This makes Commonwealth Bank one of the most expensive banks in the world.

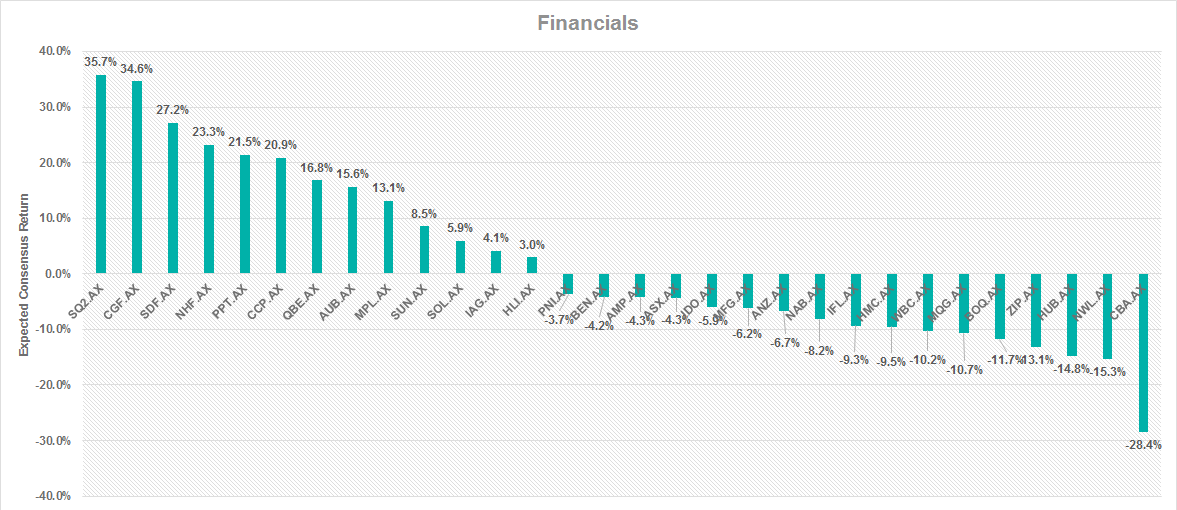

The chart below from the Burrell Galaxy compares the current market price of a stock to the consensus targets or fair value estimates from analysts. It can be seen that CBA is the outlier in the Galaxy with a return of -28% when one compares the consensus targets to the current market price. All of the banks have forecast negative returns including BOQ, Macquarie, Westpac, NAB and ANZ.

The banks performed well in the June 2024 year and were responsible for a deal of the performance. The chart indicates that it is unlikely that the banks will contribute in the same way in 2024 and may well be negative contributors. There is a key question here in terms of diversification e.g. on the chart Challenger is showing as having a 34% upside to consensus.

Data centers and AI have been the flavor of the month. It is difficult to commit further funds in these areas, given the implementation of AI remains without clear vision. It may be that internationally the consultants such as Accenture and Salesforce will ultimately be the real winners from AI as they seek to help their customers implement productivity increases as a result of AI technology available for their businesses.

Burrell Galaxy/Universe

The Galaxy was commented on in the previous section. The Burrell Universe uses a number of quantitative balance sheet and other statistics to measure a company’s soundness. Recently we have changed desktop suppliers to Refinitiv. Refinitiv is owned by LSEG (the London Stock Exchange Group). This new service is the major competitor to Bloomberg internationally. We have found it a source of additional rich data including momentum, earnings changes from analysts and risk. The Burrell Universe has been produced annually for many years, but the new financial data effectively feeds in automatically so that Burrell advisers will have additional data available to guide portfolio reviews.

Other Themes of 2024-2025

Please refer to the attached link: to the previous Blog. Those themes cover the areas of: retail, banks, Telcos, nickel, lithium, gas, Covid 19 recovery, property trusts and debts costs.

International

There has been much focus on International over the past 6 months.

a) The global macro is important as to whether the higher interest rates would cause a recession, particularly in the USA. The good news is that the economists that our firm subscribes to see a soft landing in the US. This is the Goldilocks outcome where inflation falls, interest rates do not go too high and start to reduce and business continues to grow, albeit at modest rates. This Goldilocks scenario sees unemployment ticking up but not dramatically, while inflation comes down and economic growth continues in the US. This is a positive and important outcome for the world given the importance of the US economy. Australia seems less lucky with recent articles suggesting that we may have the second highest inflation in the OECD.

b)Geopolitical: trifurcation of global markets

Following the China v USA stoush over trade policies and defence, there has been much written on the bifurcation, i.e. that China would have a set of suppliers and trading partners whilst the US would have its own set of trading partners, including greater on shoring of manufacturing previously in China and with trading partners such as Australia. Fortunately for Australia, we seem to be in both trading blocks.

Your diarist suggests that what we are seeing is in fact trifurcation of global markets. The Europeans in the EU will of course trade with both of the other blocks, but increasingly wish to have key industries where they are not dependent on China or the US. The EU economies have been weaker than the US and valuations are more modest on average. There are thus some opportunities from the trifurcation of global markets.

Burrell now have a BWET 28 list of stocks based on the holdings from the Burrell World Equities Trust. This BWET 28 list includes software/AI, defence, financials, pharmaceuticals, industrials, energy, gold, consumer and small to mid-caps. There is a general view that small-midcaps in the US are undervalued, although those companies are often equivalent to some of the larger companies in Australia.

The last 12 months have seen a greater standard deviation of portfolio returns in the 2024 financial year, than in the preceding year. Portfolios that were underweight Australian banks and International tended to underperform by about 2%, although this a general comment. The fact remains that given the pressures on Australian companies and the higher weightings on banks and resources, it seems prudent to increase the international weighting over time to say 10-15% from the lower levels around 5% which a number of clients have carried historically. Averaging in over time is a proven investment approach. There are several ways to invest overseas including Exchange Traded Funds (ETF), BWET and other Managed Funds and direct International.

Happy investing.

Disclaimer & Disclosure: Burrell Stockbroking Pty Ltd and its associate’s state that they and/or their families or companies or trusts may have an interest in the securities mentioned in this report and do receive commissions or fees from the sale or purchase of securities mentioned therein. Burrell Stockbroking and its associates also state that the comments are intended to provide information to our clients exclusively and reflects our view on the securities concerned and does not take account of the appropriateness of the recommendation for any particular client who should obtain specific professional advice from his or her Burrell Stockbroking Pty Ltd advisor on the suitability of the recommendation. Whilst we believe that the statements herein are based on accurate and reliable information, no warranty is given to its accuracy and completeness and Burrell Stockbroking Pty Ltd, its Directors and employees do not accept any liability for any loss arising as a result of a person acting thereon.

This document contains general securities advice only. In accordance with Section 949A of the Corporations Act, in preparing this document, Burrell Stockbroking did not take into account the investment objectives, financial situation and particular needs ('relevant personal circumstances') of any particular person. Accordingly, before acting on any advice contained in this document you should assess whether the advice is appropriate in the light of your own relevant personal circumstances or contact your Burrell Stockbroking advisor. If the advice relates to the acquisition, or possible acquisition, of a particular financial product, you should obtain a Product Disclosure Statement relating to the product and consider the Statement before making any decision about whether to acquire the product.

Burrell Stockbroking Pty Ltd (ABN 82 088 958 481), a Participant of the ASX Group and the NSX.

- Home

- Our Services

- About Us

- Disclaimers & Disclosures

- Burrell Online Managed Portfolios

- Burrell Online

- My Burrell Login

- My Portfolio