Chris Burrell's Market View Blog - September

Chris Burrell's Market View Blog - September

01/09/2023

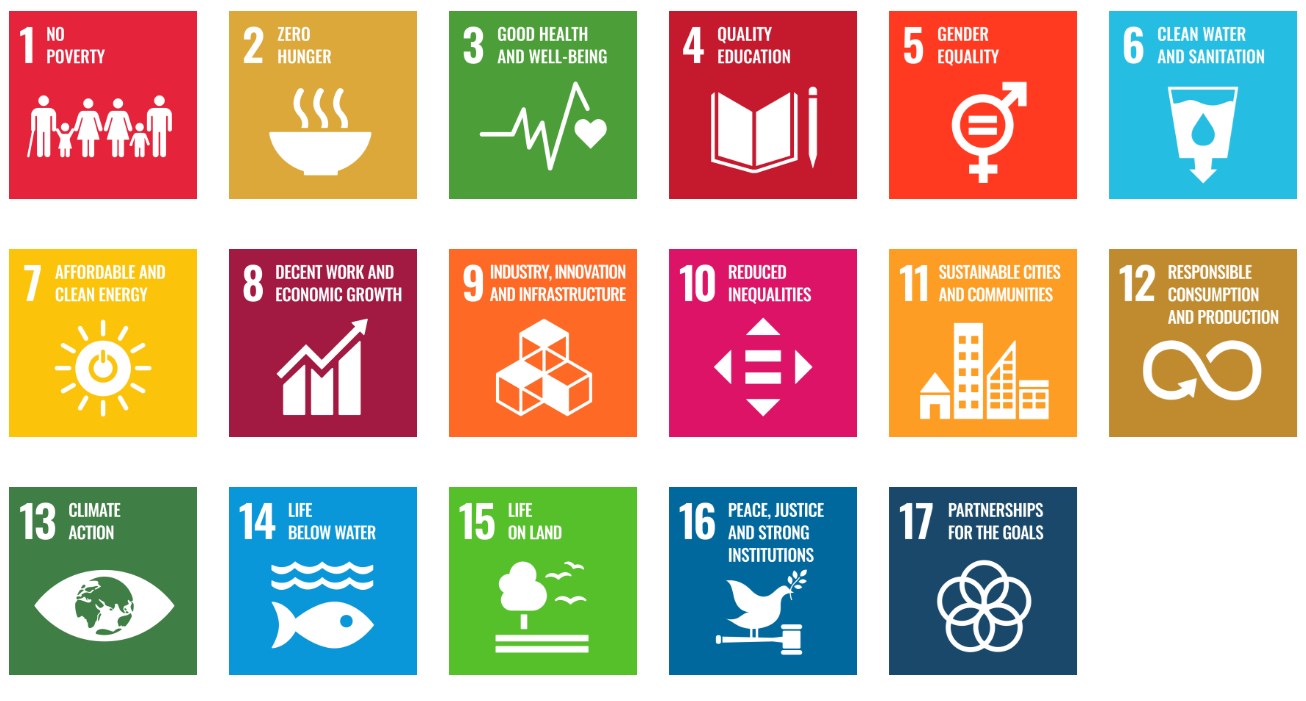

Sustainable Development Goals (SDG) - The United Nations has issued 17 Sustainable Development Goals (SDG) the chart is shown below

The goal which receives the most Press is Goal 13, climate action. This blog makes some observations on the impact of climate action on investing:

- The Earth appears to be warming.

- The most supported theme for the cause of this global warming is the increase in carbon dioxide (CO2) levels from approximately .033% of the atmosphere to .04% of the atmosphere. Some might say since when did .04% of anything matter, as 78% of the atmosphere is nitrogen, 21% is oxygen and .93% is argon. Life requires .02% CO2 and without CO2 in the atmosphere, we would all freeze. Humans breathe in oxygen and exhale CO2. Trees convert CO2 to oxygen.

- Despite the Earth’s millions of years of development, reliable data in respect of global climate including warming only exists for the last 200 years

- It is possible that global warming is caused by other factors such as sunspots or other activity from the sun. However, for the purposes of this blog, respect is paid to the view that the increase in CO2 levels is of concern.

- The climate in Australia is predominantly impacted by the oceans including El Nino/La Nina in the Pacific and the same effect (Dipole) in the Indian Ocean. This means that when it is wet on one side of the Pacific, it is usually dry on the other and similarly for the Indian Ocean. Thus when there are hot dry winds flowing down to Australia over the Kimberley region to Victoria, it is usually wet in East Africa. The monsoon is the third major effect on Australian weather, including the Madden/Julian Oscillation, being an easterly moving “pulse” of cloud around the world near the equator. Thus when the Madden/Julian Oscillation is in the vicinity of Australia, above average rain fall is probable. The fourth major impact is the Southern Annular Mode (SAM). The SAM refers to the (non-seasonal) north-south movement of the strong westerly winds that blow almost continuously in the mid to high altitudes between Australia and the Antarctic. Please refer to www.bom.gov.au for useful explanations and data on these major causes of weather in Australia.

- Your diarist has recently installed solar panels. What is clear as a result of this procedure is that basing an advanced economy, on solar and wind is to delude oneself as to the current state of such power sources. They are both uneconomic and unreliable. The climate change rhetoric is materially in advance of the practical economic realities of such power sources.

- Wind and Solar must be supported by other technologies. Historically Australia had cheap steaming coal and this was used for baseload power stations. By allowing wind and solar to dispatch whenever the sun shines or the wind blows, it interferes with the economic viability of such baseload systems. And this led in South Australia to the closure of the baseload plant and some well documented failures in the electricity system in South Australia. AGL reported last week that they were able to flex down the Bayswater Power Station by 70% and Latrobe Power Station by 45%, making a contribution to less CO2 emissions in that the baseload power station was not producing at the same level throughout a 24 hour cycle.

- The transitional fuel that has half the carbon footprint of steaming coal is natural gas.

Gas fired power stations have the ability to ramp up quickly and so to complement solar/wind. To the extent climate activists have sought to bracket coal and natural gas together, there is a failure to recognise the lower CO2 footprint of gas and its contribution to energy transition in a productive way. - Australia is not an oil producer of any significance. The geological rocks are old and weathered, with most oil seeped to the surface and floated away millions of years ago. But Australia does have good gas reserves with Woodside and Santos being globally successful Australian gas companies. China took over the production of solar panels from the US and other developed countries, achieving such production at lower costs and enhancing the economics of solar panels globally.

- But China and India with their populations of more than 1 billion are two of the major polluters globally. Statistics are often published on a per capita basis with respect to CO2 emissions, but more relevant is the total CO2 and other more environmentally damaging emissions by country. The failure by the world to properly focus on total emissions by country means that China, India and other developing countries have continued to install coal fired power stations at a rapid rate and to say that as developing countries, they should be exempt from any CO2 emission controls. This allows them to have energy costs materially less than developed countries and thus to continue to have lower production costs for goods. In effect Australian manufacturing and production is hampered by high energy costs, while overseas countries take advantage of the lack of a level playing field.

- The same applies to the production of steaming coal. Australia has some of the highest quality steaming coal in the Hunter Valley and other places. Some of the steaming coal in China, India and other developing countries has high levels of rock and other impurities, such that the ash content on burning is much more polluting. India has coal stockpiles that suffer from instantaneous combustion. Global pollution is reduced by replacing foreign country coal mines with Australian coal.

- Historically, Australians have shown opposition to the use of nuclear fuel. While this may be rational in a defence context, the use of small scale nuclear power plants should be considered in the overall context of reducing emissions. We also need to overcome the NIMBY (not in my backyard) reaction to the burial of nuclear waste. Given the huge landmass of Australia, one would have thought that good rents could be charged for storing nuclear waste.

- Australians have adopted electric vehicles (EVs) at an astounding rate. This is particularly so given the batteries in EVs are rudimentary compared to what might finally be produced by the scientists. We had been promised next generation solid state lithium batteries that would charge twice as quickly and discharge twice as slowly, giving double the distance, but these solid state batteries have been more difficult to move from the benchtop to the real world. Part of the reason is that only small magnetic impurities appear to be required for a real fire risk. We've seen a number of homes catch on fire, usually due to the wrong voltage battery charger being used or impurities in the scooter or other battery being charged. Electric motors have been available for over 100 years, so the pairing of rechargeable batteries in a car with an electric motor is an evolutionary step. To the extent that such batteries are charged, using electricity from coal fired plants at Tarong Power Station and elsewhere, one wonders whether much is being achieved. A seven year battery life of current EVs with environmental disposal costs is yet to be experienced by most EV owners.

- Assuming that EVs continue to become more economical, which means that the batteries continue to evolve into more efficient units, whilst it is not quite the same as going from the horse and cart to the motor vehicle, the transition from petrol and diesel driven motor vehicles to EVs is nonetheless dramatic. The issue from the investment point of view is how rapidly this transition will take place. The 30/30 guideline was that there would be 30% electric vehicles by 2030. The investment risk for petrol and diesel vehicles and businesses associated with those vehicles is that this transition occurs more rapidly. We are seeing already car dealers moving to diversify their product line with EVs and agencies for Chinese brands as well as Tesla's (also produced in China). We will need to carefully monitor the next breakthroughs in EV technology to see what impact they have on the rate of take up of EVs and the demise of petrol and diesel vehicles. On present economics, one would say that the transition will take 10 to 20 years, but the investment risk is towards a more rapid transition, dependent on innovations in solar, wind and batteries.

- BHP has sought to pivot towards some of the key battery minerals including nickel sulphide and copper. BHP made a take-over in 2005 of Western Mining Corporation for $7.85 per share = $A9.2B, primarily for the nickel assets of WMC. In recent times they have sought to build a series of nickel mines around the central processing plant in order to become a more significant producer of battery grade nickel. Interestingly, BHP have so far chosen to sit out the lithium sector. Lithium tends to occur in smaller mines and BHP have queried whether they can add value as a major miner to these smaller deposits. Lithium pricing has also been volatile.

- Lithium is the preferred key element in EV batteries. In 2021 VW, the car manufacturer surprised by including manganese cathodes in their preferred battery design. Chinese manufacturer Gotion High-Tech claimed (Mn) manganese doped L600 LMFP (lithium manganese iron phosphate) batteries boast a life cycle of 4000 charge/discharge cycles and a lifetime range of 4 million kilometers. The ranges up to 1000 kilometers for a single charge, double the current standard. Australian companies including S32 and BHP with manganese and nickel sulphide would be beneficiaries of this shift, as less cobalt results in more nickel sulphide for each battery.

- Australian lithium producers are split into brine producers in South America and Hard Rock Mining in Australia. The brine in South America is pumped from Solars (Lakes) high in the Andes, the water is evaporated similar to mining salt and the salt is purified and sent to the lithium hydroxide plants. Allkem Limited, formerly (Orocobre Limited), a Brisbane based company, has a lithium hydroxide plant in Japan, which is currently being commissioned.Following their merger with Galaxy, they also have Hard Rock Mining in Western Australia. These Hard Rock mines are similar to gold and other mining in so far as one crushes the rock, and then adds various flocculants etc. to form a spodumene which is then mostly exported to China for refining. Allkem is presently subject to takeover by Livent in New York. Global players are also involved in Western Australia including partnerships between SQM and the Australian listed company, IGO Limited.

- There is much research being undertaken both in Australia and overseas around battery minerals. QUT has a facility in Brisbane at Banyo where they test various compounds including lithium seeking to develop the next breakthrough in battery technology. QUT is also researching super conductive materials. The advantage of these is that copper transmission wires lose 15% of the power over reasonable distances, whereas some of the super conductive materials have almost no losses. One could envisage solar farms along the Adelaide to Darwin railway line producing energy for hydrogen production and also feeding superconductive connectors to the Queensland grid.

- Batteries for houses and the charging of vehicles are not sufficiently economic at this point to suggest widespread use. It is likely that the winner in commercial and home batteries will not be lithium, but rather a liquid battery. Contenders include vanadium redox flow batteries (VRFBs), zinc bromine and newcomer, calcium-antimony.

- Wind powered turbines are also struggling with production issues. Siemens Energy has recently noted metal fatigue in some of its large wind blades and housing, announcing a major recall.

- During the 1890’s a political consensus insisted that railways should cross the State of Victoria, and railways were built to a great deal of small towns and locations. Ultimately many of these were uneconomic, but the large investment very nearly bankrupted the State of Victoria. Your Diarist has concerns that the current push to green energy without any caveat as to economic viability and with the call to reducing CO2 as the only justification - that this movement has the potential to create over investment in unproven uneconomic technologies.It is important that micro economic costs and benefits determine economically viable energy outcomes, rather than the altruistic adoption of alternate technologies at any cost to reduce CO2.There will need to be some subsidies, which should be explicit to continue the evolution towards sustainable development goals.

Happy Investing,

Chris Burrell

Managing Director

Disclaimer & Disclosure: Burrell Stockbroking Pty Ltd and its associate’s state that they and/or their families or companies or trusts may have an interest in the securities mentioned in this report and do receive commissions or fees from the sale or purchase of securities mentioned therein. Burrell Stockbroking and its associates also state that the comments are intended to provide information to our clients exclusively and reflects our view on the securities concerned and does not take account of the appropriateness of the recommendation for any particular client who should obtain specific professional advice from his or her Burrell Stockbroking Pty Ltd advisor on the suitability of the recommendation. Whilst we believe that the statements herein are based on accurate and reliable information, no warranty is given to its accuracy and completeness and Burrell Stockbroking Pty Ltd, its Directors and employees do not accept any liability for any loss arising as a result of a person acting thereon.

This document contains general securities advice only. In accordance with Section 949A of the Corporations Act, in preparing this document, Burrell Stockbroking did not take into account the investment objectives, financial situation and particular needs ('relevant personal circumstances') of any particular person. Accordingly, before acting on any advice contained in this document you should assess whether the advice is appropriate in the light of your own relevant personal circumstances or contact your Burrell Stockbroking advisor. If the advice relates to the acquisition, or possible acquisition, of a particular financial product, you should obtain a Product Disclosure Statement relating to the product and consider the Statement before making any decision about whether to acquire the product.

- Home

- Our Services

- About Us

- Disclaimers & Disclosures

- Burrell Online Managed Portfolios

- Burrell Online

- My Burrell Login

- My Portfolio