Australia & International Holdings Limited

Australia & International Holdings Limited

Burrell's own Listed Investment Company

Australia & International Holdings Limited (AIH) is an investment company whose primary objective is to provide investors with dividend returns as well as capital growth. AIH originated in 1985 when a group of investors formed an investment club, with the investment portfolio initially held by a private company before becoming Australia & International Holdings Limited in 1998.

As at 30 June 2025, AIH had net assets of approximately $5.78 million held in a strategically balanced and well-diversified set of portfolios. The majority of investor funds are allocated over a medium to long-term period across Australian and international companies, as well as managed funds. Investment exposure is primarily achieved through interests in the Burrell Australian Equities Trust, the Burrell World Equities Trust, and the Burrell Smallcap, Midcap & Resources Trust, providing diversified access to these underlying portfolios

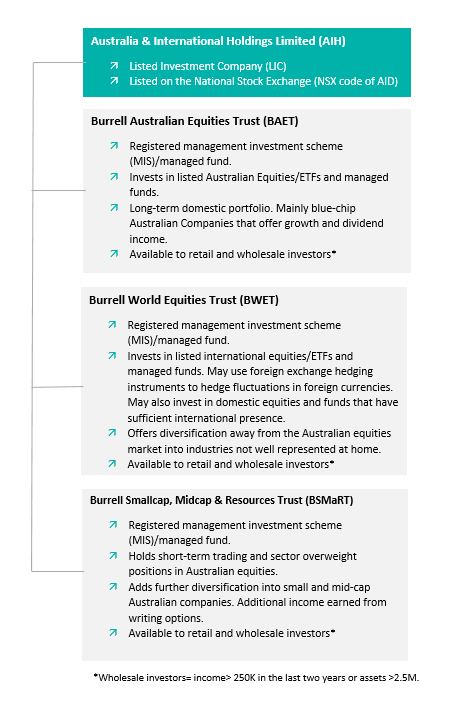

As shown in Figure 1, most AIH investments are facilitated through its managed investment schemes: Burrell Australian Equities Trust (BAET), Burrell World Equities Trust (BWET), and the Burrell Smallcap, Midcap and Resources Trust (BSMaRT).

Figure 1. AIH structure.

As at 30 June 2025, approximately 98.5% of AIH’s investment portfolio was invested in BAET (59.2%), BWET (28.2%) and BSMaRT (11.20%). This was achieved through the following ownership structure: AIH owned 39.2% of the units on issue in BAET, 22.1% of the units on issue on BWET, and 24.9% of the units on issue in BSMaRT.

Through the three portfolios, AIH invested in the following industry sectors, countries and companies/investments:

| AIH investment industry sectors | 30-Jun-25 % |

Energy | 4.1 |

Materials | 17.3 |

Industrials | 7.7 |

Consumer discretionary | 4.9 |

Consumer staples | 4.8 |

Financials | 28.0 |

Managed funds and LICS | 11.5 |

Health Care | 8.7 |

Information technology | 6.1 |

| Telecommunication Services & Utilities | 6.1 |

Real estate investment trusts | 0.8 |

Region allocation | 30-June-25 % |

Australia & New Zealand | 75.7 |

Americas | 8.3 |

United Kingdom | 0.6 |

Europe excl. United Kingdom | 5.2 |

Asia Pacific excl. Australia | 1.3 |

Global | 8.9 |

Top 20 underlying investments | 30 Jun 25 (% of underlying portfolio) |

ANZ GROUP HOLDINGS LIMITED FPO | 8.21% |

AMCOR PLC CDI 1:1 FOREIGN EXEMPT NYSE | 5.74% |

| APA GROUP FULLY PAID UNITS STAPLED SECRUITIES | 4.31% |

Incometric Fund - Class B | 4.06% |

NEWMONT CORPORATION CDI 1:1 FOREIGN EXEMPT NYSE | 3.57% |

CSL LIMITED FPO | 2.55% |

MACQUARIE GROUP LIMITED FPO | 2.43% |

| WOODSIDE ENERGY GROUP LTD FPO | 2.23% |

SANTOS LIMITED FPO | 2.19% |

CHALLENGER LIMITED FPO | 2.16% |

WESTPAC BANKING CORPORATION FPO | 2.02% |

AUSTRALIAN FOUNDATION INVESTMENT COMPANY LIMITED FPO | 1.68% |

SONIC HEALTHCARE LIMITED FPO | 1.48% |

SOUTH32 LIMITED FPO | 1.41% |

BHP GROUP LIMITED FPO | 1.25% |

MICROSOFT ORD | 1.19% |

NATIONAL AUSTRALIA BANK LIMITED FPO | 1.17% |

WOOLWORTHS GROUP LIMITED FPO | 1.06% |

ING GROUP ORD | 1.05% |

APPLE ORD | 1.05% |

Shareholder information

AIH Unit Price

| Week Ended | AIH Unit Price ($) |

05/02/2026 | 3.37 |

29/01/2026 | 3.42 |

22/01/2026 | 3.41 |

15/01/2026 | 3.40 |

08/01/2026 | 3.35 |

31/12/2025 | 3.33 |

23/12/2025 | 3.34 |

18/12/2025 | 3.31 |

Annual Reports

Dividend history

AIH has a strong history of paying dividends and its dividend yield compares very well.

Year | NAV (¢) | Interim ordinary dividends per share (¢) | Interim dividend franking (%) | Final dividends per share (¢) | Final dividend franking (%) | Total dividends per share (¢) | Dividend yield (%) |

2025 | 325 | 6.5 | 100 | 6.8 | 100 | 13.3 | 4.1 |

2024 | 320 | 6 | 100 | 6 | 100 | 12 | 3.8 |

| 2023 | 316 | 6.0 | 100 | 6.0 | 100 | 12.0 | 3.80 |

| 2022 | 304.00 | 5.0 | 100 | 5.5 | 100 | 10.5 | 3.45 |

2021 | 318.00 | 4.5 | 100 | 4.5 | 80 | 9.0 | 2.83 |

2020 | 285.00 | 6.0 | 100 | 4.5 | 100 | 10.5 | 3.85 |

2019 | 313.00 | 6.0 | 100 | 6.5 | 100 | 12.5 | 3.96 |

2018 | 305.00 | 6.0 | 70 | 6.0 | 65 | 12.0 | 3.93 |

2017 | 301.00 | 6.0 | 70 | 6.0 | 75 | 12.0 | 3.99 |

2016 | 291.00 | 6.0 | 75 | 6.0 | 75 | 12.0 | 4.26 |

Dividend Reinvestment Plan

AIH operates a dividend reinvestment plan that enables shareholders to receive all or part of their dividends in shares. For full details of the plan and application form, please follow the links below:

Get started

Contact us for an obligation-free conversation.

Call 1300 4 BURRELL or read the most recent AIH newsletter for the latest news and investment results.

- Home

- Our Services

- About Us

- Disclaimers & Disclosures

- Burrell Online Managed Portfolios

- Burrell Online

- My Burrell Login

- My Portfolio